Fox News recently took aim at Sen. Tammy Duckworth (D-Ill.) in an apparent attempt at a “gotcha” story about how Duckworth – who lost both of her legs when the Army Black Hawk helicopter she was piloting was shot down over Iraq in 2004 – doesn’t pay property taxes on her Illinois home.

The story, published on Sunday, claimed that Duckworth was getting “slammed” for “taking advantage of a tax break” that has exempted her from Cook County, Illinois property taxes since 2015.

It’s not until lower in the story that it’s revealed there is nothing scandalous about this at all. Duckworth is not getting a tax break that only the rich and powerful enjoy. Rather, the Illinois General Assembly passed a law in 2015 that made veterans with a service-connected disability rating of at least 70% exempt from property taxes.

In addition to benefits from the Department of Veterans Affairs, like the VA Home Loan, some veterans are eligible for exemptions when buying their homes. Though as the mortgage lender Veterans United notes, the exact type of exemption — from waiving property taxes, to forgoing one-time fees — varies state-by-state, and even county-by-county.

In other words, Duckworth is using a benefit that she and other veterans qualify for.

“It’s disheartening that anyone would smear disabled veterans for using benefits they earned through their service to this nation, but it really says more about the people attacking those brave veterans than it does about Senator Duckworth,” said Ben Garmisa, a spokesman for the senator.

Alex Plitsas, a former sergeant in the Army Reserve, tweeted on Monday that some states offer property tax discounts to wounded warriors and other states rightly allow veterans with a 100% disability rating to avoid paying property taxes at all.

It was Fox’s framing of the story that drew immediate criticism on social media because it made Duckworth, a combat-wounded veteran, look like a tax cheat, prompting some to suggest that Fox was calling for a reevaluation of veterans’ disability benefits.

“They should be ashamed of themselves, but that would require empathy, and it’s clear FOX News cares more about pandering to its right-wing base than caring about accuracy,” the liberal veterans group VoteVets wrote in a tweet, adding that the senator “MORE than earned her veteran benefits.”

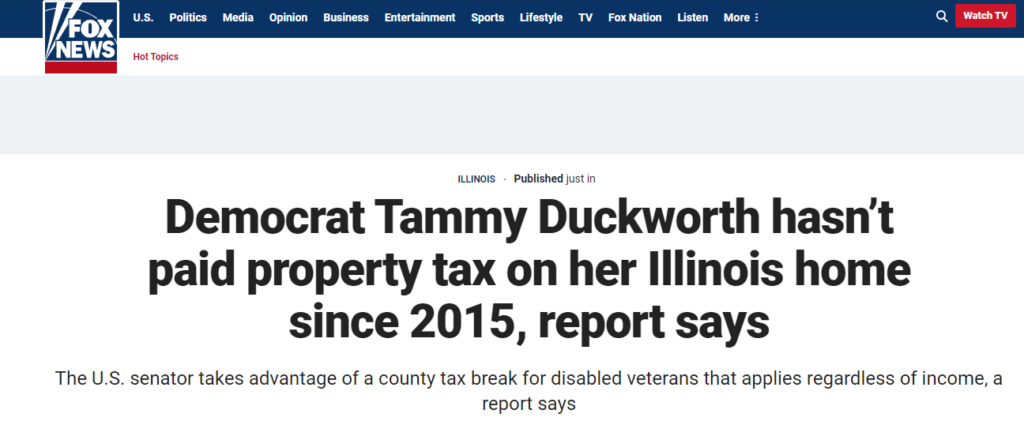

It appears Fox News may have realized what it stepped into because it changed its initial headline from “Democrat Tammy Duckworth hasn’t paid property tax on her Illinois home since 2015, report says” to something a little more benign: “Democrat Tammy Duckworth slammed for getting tax break on her Illinois home.”

The Fox News article was a follow-up to a story first published in the Chicago Sun-Times about how Duckworth is one of more than 27,000 Cook County residents who do not pay property taxes due to exemptions enacted by Illinois state lawmakers.

The crux of the Chicago Sun-Times story is that the exemption for disabled veterans that has allowed Duckworth to avoid paying more than $42,000 in property taxes applies to people who are wealthy.

Duckworth’s annual salary as a senator is $174,000 and she has earned more than $300,000 in royalties on her book “Every Day Is A Gift,” the newspaper reported. In 2017, she and her husband purchased a six-bedroom home for $1.3 million in Virginia, where they paid more than $16,000 in property taxes this year.

Neither Fox News nor the Chicago Sun-Times provided any comment for this story.

Former Army Sgt. David Weissman told Task & Purpose that he felt the Fox News story was a “hot mess” and he believes the cable news network owes Duckworth a public apology.

“It all goes to show you how much they actually do support veterans, which in reality they don’t,” said Weissman, who served as a chaplain assistant from 2007 until 2012, during which he deployed to Afghanistan twice. “Veterans are only used as props when it comes to conservative pundits or politicians. I thought it was very unprofessional.”

More great stories on Task & Purpose

Want to write for Task & Purpose? Learn more here and be sure to check out more great stories on our homepage.